Verifying a customer’s identity — known as Know Your Customer or KYC — has become a crucial step for building trust between businesses and their users in today’s digital world.

More than just a formality when onboarding new clients, KYC is now one of the most effective tools for preventing digital fraud and reinforcing trust and security in online interactions.

Because of its growing importance, adopting this kind of technology is now essential for companies that need to comply with both national regulations (such as Spain’s SEPBLAC) and European directives (AML6 / KYC / CTF) designed to fight money laundering and the financing of terrorism.

Table of contents

Compliance and global regulations in identity verification

The way remote identity verification is regulated can vary widely from one country to another. However, every jurisdiction shares the same goal: ensuring that all digital transactions are transparent, secure and trustworthy.

Let’s have a look at the leading legal frameworks you should be aware of.

Supervision and regulations in Spain (SEPBLAC and AML compliance)

In Spain, the Law on the Prevention of Money Laundering and the Financing of Terrorism (Law 10/2010, 28 April) defines the obligations companies must meet to prevent criminal misuse of financial and business systems.

These obligations apply not only to banks and financial institutions, but also to a broad range of professionals and sectors , from real estate agencies and lawyers to auditors and jewellers.

The main goal of this legislation is to stop the financial system being used to launder money from illegal activities or to fund terrorism. It also establishes a strict penalty regime for organisations that fail to comply.

Main KYC and AML6 compliance measures include:

- Customer identification: verifying every client’s identity before a business relationship begins.

- Ongoing transaction monitoring: setting up internal systems to detect suspicious activity.

- Understanding the business purpose behind the relationship.

- Reporting suspicious operations: notifying SEPBLAC (Spain’s Financial Intelligence Unit) if a transaction may be linked to criminal activity.

- Document retention: keeping identification and transaction records for a minimum of 10 years.

SEPBLAC: Spain’s financial intelligence unit explained

SEPBLAC (Servicio Ejecutivo de la Comisión de Prevención del Blanqueo de Capitales e Infracciones Monetarias) is the Spanish authority responsible for preventing money laundering and terrorist financing.

It operates under the Ministry of Economic Affairs and Digital Transformation and includes representatives from the Bank of Spain, CNMV, National Police, Civil Guard, and Tax Agency.

Under its framework, SEPBLAC has approved the use of automated video identification, establishing technical and legal requirements to guarantee its validity and reliability.

SEPBLAC-approved digital identity verification and video identification

Digital identity verification systems authorised by SEPBLAC must comply with the following standards:

- Reliable identification through biometric and document validation.

- Full display of both sides of the ID.

- Real-time recording (live audio and video).

- Verification performed on a single device.

- Secure storage of electronic evidence.

- Advanced fraud detection and risk management.

- Data protection compliance under GDPR.

- Managed by qualified professionals.

eKYC Video is a secure, certified and SEPBLAC-compliant solution for digital identity verification.

Digital identity verification in the EU: AML6, CTF and GDPR compliance

Across Europe, the fight against money laundering and terrorism has evolved with the AML/CFT 2024 package, complemented by eIDAS and eIDAS 2 regulations.

Since 2016, the AML4, AML5 and AML6 directives have extended KYC and due diligence requirements to more sectors, strengthening the verification of beneficial ownership and enforcing tighter fraud prevention controls.

The new European Anti-Money Laundering Authority (AMLA) now coordinates these efforts, ensuring consistency across all EU states.

Technical standards and GDPR data protection

The ETSI EN 319 401 and ETSI EN 319 411-1 standards define the level of assurance required for trust service providers in identity verification.

Meanwhile, the General Data Protection Regulation (GDPR) safeguards the privacy and data rights of all EU citizens across digital identification processes.

→ Request a free eKYC Video demo and ensure compliance with AML6, SEPBLAC and GDPR today.

Staying compliant with eKYC Video

In this fast-moving regulatory landscape, eKYC Video is designed to grow alongside new laws — ensuring your company always meets the latest compliance and identity verification standards.

Why your business needs a compliant video identification system

Whether your business is in finance, real estate or technology, using a compliant video identification system like eKYC Video helps you:

- Identify customers accurately and securely.

- Prevent financial crime and digital fraud.

- Maintain trust and protect your brand reputation.

- Ensure seamless AML and KYC compliance.

- Improve efficiency in onboarding and verification workflows.

→ It’s time to integrate eKYC Video into your digital onboarding process.

eKYC Video: fast, secure digital identity verification

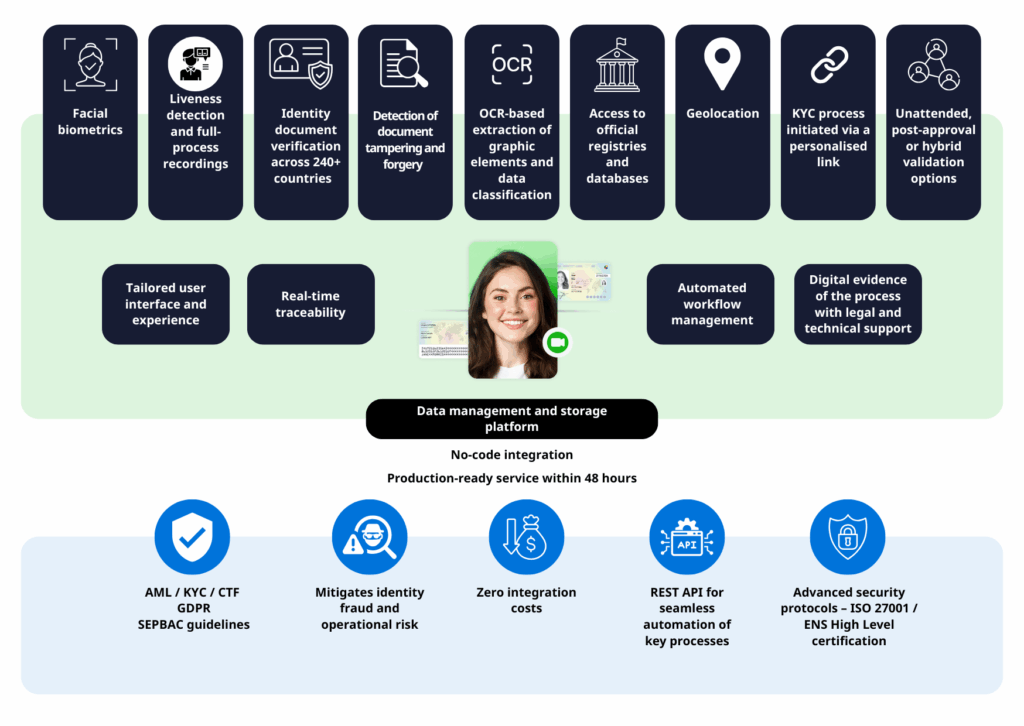

Lleida.net’s eKYC Video detects fraud in real time. As a no-code platform, it can be deployed in hours — providing a tailored, branded customer experience without complex integration.

Key features include:

Future-proofing your business with identity verification technology

As cyber threats grow more sophisticated, innovation in digital identity verification has become a strategic priority.

New technologies such as biometrics, blockchain-based decentralised identity, AI-powered machine learning, and passwordless authentication are shaping the next generation of secure, frictionless identity experiences.

At Lleida.net, we continue to push boundaries — combining compliance, technology and innovation to help businesses stay ahead of regulatory and security challenges.

FAQs on KYC, AML and eKYC Video

What is digital identity verification?

It’s a process that uses technology — including biometric recognition and document analysis — to confirm a person’s identity, helping to prevent fraud and unauthorised access.

What documents are accepted by eKYC Video?

You can use an official photo ID such as a passport, national identity card , residence permit or driving licence. eKYC Video supports over 240 international document types.

How does the video identification process work?

- Document capture: both sides of the ID are scanned for authenticity.

- Facial verification: the system matches a selfie with the ID photo using advanced algorithms and live checks like blinking or head movements.

- Automatic validation: once verified, the process is stored securely and made available on the management platform.

Why choose eKYC Video?

- Rapid deployment (under 48 hours)

- Full compliance (SEPBLAC, AML, GDPR)

- Customisable UX/UI

- Integration with other Lleida.net registered services

- No-code configuration